15+ wa liquor tax calculator

Divide tax percentage by 100. Washington recently privatized liquor sales and with it came a new pricing structure for liquor.

Us Kch1sxc5bwm

Calculate total liquor cost in all 50 states without going to the register.

. Since spirits purchases made by licensed on-premises. This simple app does one thing -- lets you input the price and size of the bottle of liquor and then it tells you the total cost. Washington State Alcohol Tax Calculator.

Those taxes combined give Washington. While the privatization did. While the privatization did.

You can total the cost of 1 2 3 or as many as. This is the ALMOST original Washington Liquor tax Calculator for Android and the most complete liquor solution to date It is designed for the true Washington Liquor shopper and enthusiast. You have to enter a decimal number with dollars and cents ya jack-tard.

WA Liquor Tax Calculator. 1800 per 31-gallon barrel or 005 per 12-oz can. Select State DC or US.

107 - 340 per gallon or 021 - 067 per 750ml bottle. The tax rate for on-premises retailers such as restaurants bars etc is 137 percent. Washington State Alcohol Tax Calculator Vecheinfo 15.

The term spirits means any beverage containing alcohol that is obtained by. Beer Federal Tax Calculator. The washington excise tax on liquor is 3522 per gallon one of the highest liquor taxes in the country.

Washingtons general sales tax of 65 also applies to the. The second is a volume tax called the spirits liter tax which is equal to 37708 per liter retail or 24408 per liter restaurants and bars. Find out with the wa liquor tax calculator.

350barrel applies to the first 60000 barrels for a domestic brewer who produces less than 2 million barrels per year. Control State Spirits The Alabama beer excise tax was last changed in 1969 and has lost 83 of its value. The tax rate for sales to consumers is 205 percent.

Find out with the WA Liquor Tax Calculator. Get Washington State Liquor Tax Calculator for iOS latest version. Multiply price by decimal.

Washington State Alcohol Tax Calculator Vecheinfo 15. If the tax had. Washington State Alcohol Tax Calculator.

From the drop down menu. List price is 90 and tax percentage is 65. The price of the coffee maker is 70 and your state sales tax is 65.

65 100 0065. The tax rate for sales to consumers is 205 percent. Calculate total liquor cost.

Federal excise tax rates on beer wine and liquor are as follows. Quickly calculate the total price including sales tax and volume tax of liquor sold in the state of washington in as little as four taps. The spirits liter tax is a tax on the sales of spirits in the original container and is based on the volume sold.

WA Liquor Tax Calculator. Washington State Liquor Tax Calculator. Download Washington State Liquor Tax Calculator App 221 for iPad iPhone free online at AppPure.

The tax rate for sales to consumers is 205 percent.

Washington Income Tax Calculator Smartasset

Average Real Federal Excise Taxes In Dollars Per Barrel On Alcoholic Download Scientific Diagram

Washington State Liquor Tax Apps On Google Play

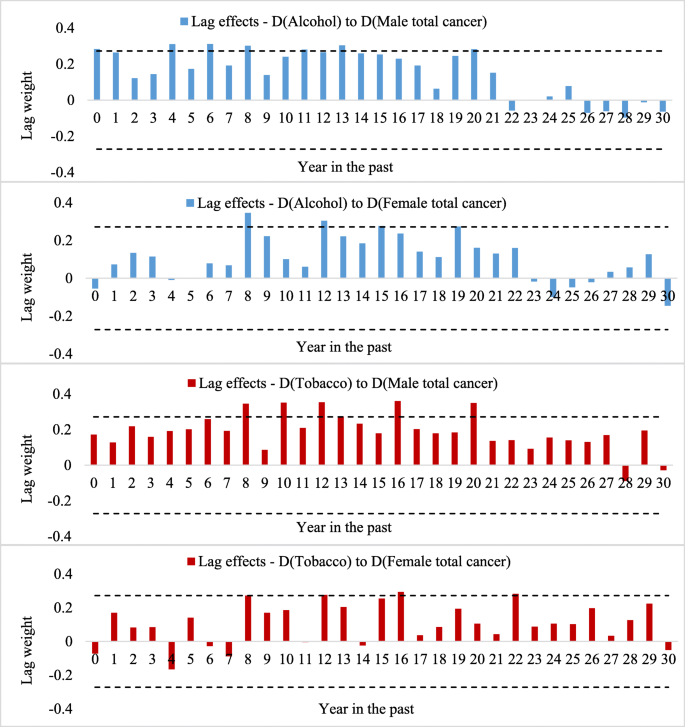

Underage Access To Alcohol And Its Impact On Teenage Drinking And Crime Sciencedirect

Washington Alcohol Taxes Liquor Wine And Beer Taxes For 2022

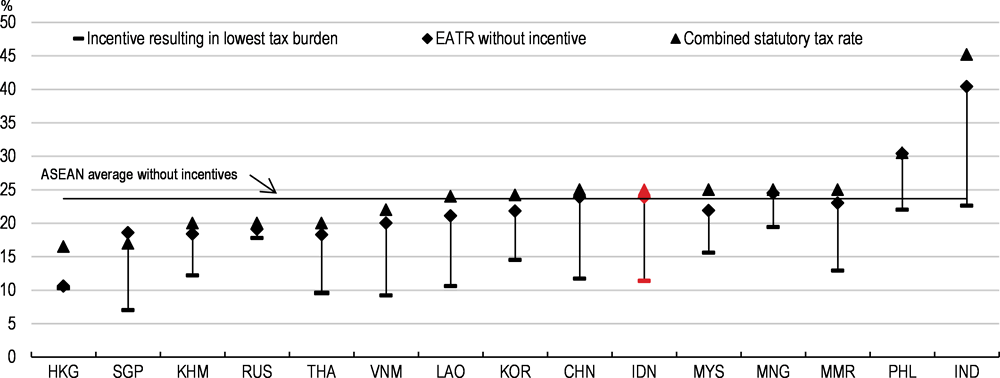

6 The Economics Of Alcohol Consumption In Brazil Oecd Reviews Of Health Systems Brazil 2021 Oecd Ilibrary

Dry Gin Poster Retro Gin Ad Bar Poster Barware Wall Art Etsy Schweiz

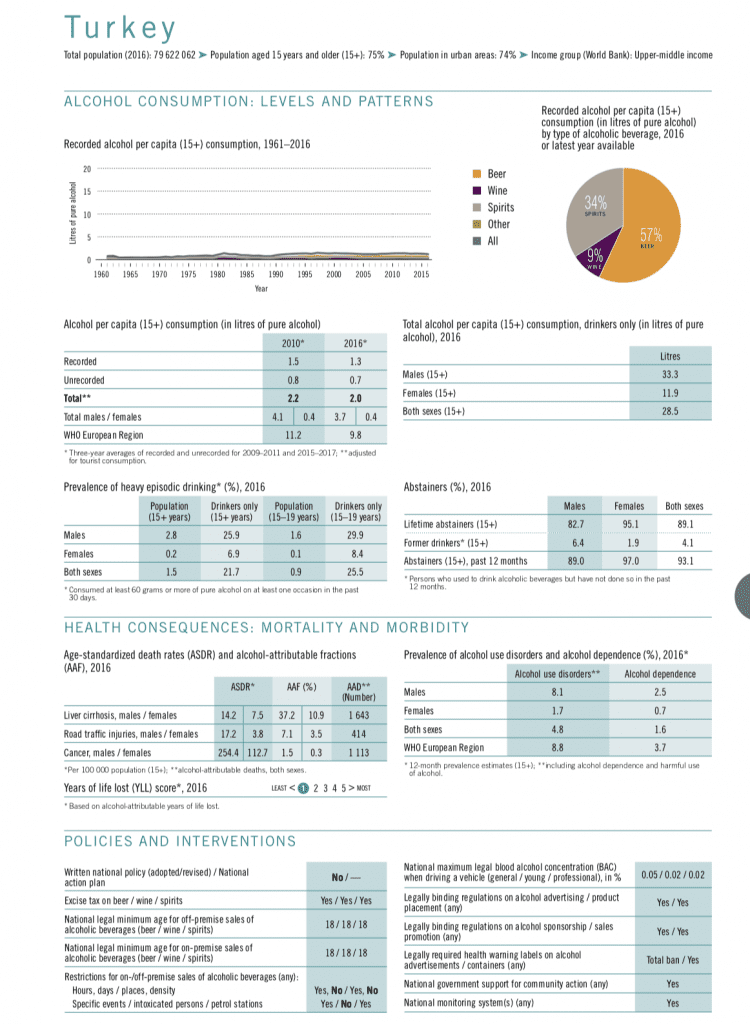

Turkey Raises Alcohol Tax By 13 5 Movendi International

Washington State Liquor Tax Calculator Free Download And Software Reviews Cnet Download

Pdf The Pass Through Of Alcohol Taxes To Prices In Oecd Countries

Washington State Liquor Tax Calculator Free Download And Software Reviews Cnet Download

Home Oecd Ilibrary

Measuring The Effects Of The New Ecowas And Waemu Tobacco Excise Tax Directives Tobacco Control

Washington Income Tax Calculator Smartasset

Tax Calculator

Latvia Lv Alcohol Consumption Rate Projected Estimates Aged 15 Male Economic Indicators Ceic

Alcohol Consumption In The United States Past Present And Future Trends Journal Of Wine Economics Cambridge Core